Educational organizations today face a significant challenge: attracting and enrolling students while navigating financial constraints. Trends have shown that students often don’t complete the enrollment due to upfront tuition costs, leading many to forgo their educational dreams. Educational organizations, on the other hand, struggle with managing cash flow and ensuring consistent revenue streams.

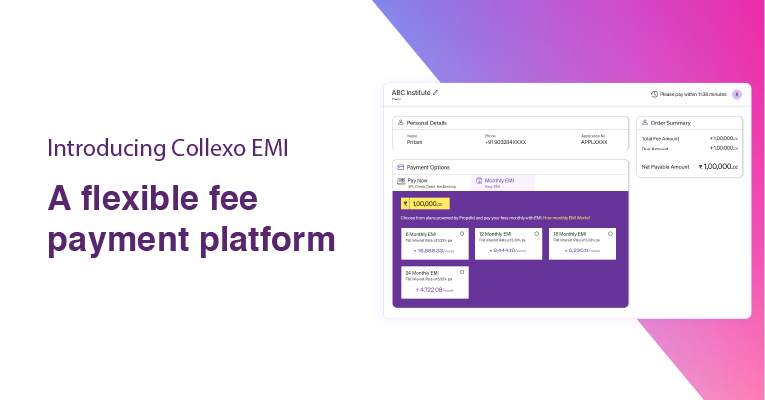

The need for a solution that addresses both student affordability and institutional financial health has never been more critical. Educational organizations require a mechanism that provides flexibility for students while securing immediate revenue for the institution. That’s where Collexo EMI comes into play. The solution to this problem has been within reach all along—Collexo EMI.

The problem: Financial barriers leading to decreased enrollments & organizational growth

Many students encounter difficulties with paying upfront tuition fees that create obstacles for educational organizations in growing enrollments and revenue. These financial barriers can lead to decreased enrollment and increased dropout rates, while educational organizations face challenges in managing cash flow and maintaining financial stability. The result is a cycle of uncertainty that affects both students and organizations.

The solution: Collexo EMI

Collexo EMI addresses these issues by offering a flexible payment solution that benefits both students and educational organizations. Students can choose from short-term EMIs or long-term loans, easing the financial burden of upfront costs. Meanwhile, your institution receives the full fee immediately, ensuring a steady revenue stream without waiting for payments to be completed.

By integrating Collexo EMI, you make your institution more accessible to students and drive growth through increased enrollment. Let’s see how,

Get the entire fee upfront: With Collexo EMI, students can opt for short-term EMIs or convert their payments into long-term loans, but organizations receive the full payment immediately. This way, you don’t have to wait for your revenue.

Drive enrollment growth by easing financial strain: By integrating Collexo EMI into your fee collection process, you can reduce the financial strain on students, making it easier for your educational organization to retain existing students and attract more prospective students and row your enrollments.The flexible payment options not only help students manage their finances better but also encourage them to commit to their educational goals without hesitation. As a result, you can enhance your fee collection and management, while also supporting the continuous growth of your organization.

Maintain financial stability: Collexo EMI’s guaranteed upfront payments lead to a steady revenue stream for your educational organization. With reduced dropout rates and enhanced financial stability, you can focus on what matters most—growing your educational organizations and fostering a thriving learning environment. The security of knowing that your fees are covered allows you to plan for the future with confidence.

To conclude:

In today’s competitive educational landscape, addressing financial barriers and maintaining financial stability is crucial for the success of your educational organization. Collexo EMI offers a powerful solution that not only enhances student accessibility but also secures immediate revenue for your educational organization. By adopting Collexo EMI, you can overcome the challenges of upfront costs, boost enrollment, and ensure a stable financial foundation for your organization.

So are you ready to unlock new opportunities for growth of your educational organization? Schedule a free 30-minute demo with our expert and get started today!